Ng IL Shan

“A second natural gas revolution is underway, this time caused by LNG,” said Mr Peter Fraser, Head of Gas, Coal and Power Markets Division, International Energy Agency (IEA).

Prominent features of this revolution include a projected surge in LNG supply between 2016 and 2020, increasing LNG demand by developing countries to beyond 50 percent of all imports by 2022, and the evolution of LNG agreements toward destination-flexible and shorter contracts.

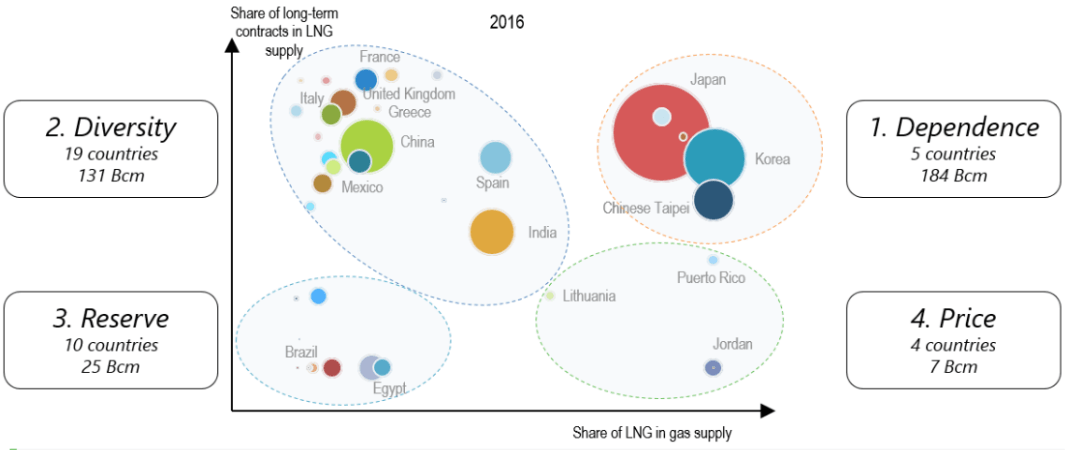

To navigate this evolving LNG landscape, IEA proposed a framework that classifies LNG-buying countries into four different types according to their security of supply needs (Fig. 1). Buyers of the “Price” type, like Puerto Rico and Jordan for instance, are sensitive to changes in LNG price because of their high reliance on LNG, but tend towards short-term contracts. IEA predicts that countries of the “Diversity” type will see the largest increase in LNG demand by 2022.

Fig. 1: Four types of LNG buyers, based on their security of supply needs

Source: Global Gas Security Review 2017, IEA

The roundtable participants shared some of the supply security challenges that their respective jurisdictions may face in light of this second revolution.

Mr Bradford Simmons, Asia Energy Policy Advisor, U.S. Department of State, said that with increasing use of natural gas, the U.S. would have to explore protocols for fuel switching and demand suppression to alleviate the impacts of prolonged supply disruptions.

For ASEAN, a single regional LNG market where member states can freely buy LNG from one other through the use of destination-flexible contracts could ease supply security concerns, said Mr Paramate Hoisunwan, Senior Analyst, PTT Plc.

Mr Vickrem Vijayan, General Manager of SembCorp Gas, gave Singapore’s take on gas supply security by voicing the need for greater private sector involvement to find efficient solutions in a highly unpredictable global market.

From security of supply, the discussion later turned to grid security as participants weighed in on the decentralised versus centralised distribution debate.

Er. Seow Kang Seng, Principal Consultant, Clean Technology Centre, DNV GL – Energy, expressed a conservative view. He said that regardless of how advanced grid technology becomes, a central system operator will always be needed to mediate such contingencies as total blackouts. Moreover, innovations such as microgrids would have to be rigorously tested by independent consultants before deployment, so as to minimise the risk of accidents.

Governments have to let innovative technologies flourish by reworking policy and regulation to facilitate the rapid adoption of distributed grid elements, said a member of the audience. When asked about the future electricity outlook of developing countries, Mr David C. Elzinga, Senior Energy Specialist, Asian Development Bank, said he expects things to go poorly for some countries that might choose to invest in traditional generation systems only to be hit by the wave of renewables.

“Some countries are so afraid to touch solar PV because they are worried about what it will do to their grids,” Mr Elzinga said. “We need to try to pass on the mistakes and the good practices to the developing world.”