The recent Tohoku earthquake, pursuant tsunami and nuclear crisis have unleashed a national crisis in Japan on a scale not seen since World War II. While the Government is desperately trying to prevent massive radiation leaks at four nuclear reactors and continues to press on with recovery efforts at battered coastal villages, it is now facing critical scrutiny over the flaws in its electricity system made obvious by the horrific spate of disasters.

In the directly affected areas of the disaster, electricity services were provided by the Tokyo Electric Company (TEPCO) and the Tohoku Electric Company (Tohoku-EPCO).

Tohoku-EPCO suffered critical damage to its systems with one nuclear plant and four thermal plants shut down, leaving some of the worst-hit disaster areas with total blackouts. However, the utility escaped the nuclear crisis that TEPCO now faces. TEPCO owns the Fukushima Dai-ichi and Fukushima Dai-ini nuclear plants with six and four reactors each, accounting for a total of 9.1GW of base load power generation capacity.1

Although not all the reactors at both plants were stricken in the earthquake, it can be expected that all reactors will be shut for a prolonged period of time, if not permanently. At the TEPCO-owned oil-fired power plants, 5.15GW of generation capacity were shut down following the quake and will likely remain unavailable until adequate checks are performed and repairs made. TEPCO's biggest 1GW coal-fired power plant was also damaged in the quake.2

Also taking into account power generation capacities which were mothballed before the quake, this leaves TEPCO with about 42GW of existing power generation capacity, 35 percent less than its built capacity of 64.5GW and barely fulfilling electricity demand which fell significantly due to a drop in manufacturing output following the earthquake.3 Of the 42GW of power generation capacity, not all is currently online due to scheduled maintenance shutdowns. As of 28 March, TEPCO had only 37GW of power generation capacity online, including some borrowed from other utilities.

This begs many questions about the future of Japan's electricity systems. How adequately can TEPCO and TohokuEPCO cope with the dearth in electricity supply in the short and long.

The 2007 and 2011 earthquakes compared

To answer these questions, it is useful to recall a similar event in 2007. In July that year, a large amount of power generation capacity was suddenly taken off the grid following the closure of the 8.2GW Kashiwazaki-Kariwa nuclear power plant, also owned by TEPCO, after the magnitude 6.6 Chuetsu offshore earthquake. The relatively minor damage to the Kashiwazaki nuclear plant compared with the 11 March 2011 event meant it was shut down for a two-year inspection, with some reactors coming back online only recently.

The power shortage then was particularly worrying as it took place at a time when power demand was at its peak during the height of summer, often surpassing 60GW.4 For perspective, the typical power demand in March is around 40GW. However, in 2007, there was significantly more maneuverability to recover from the earthquake.

Back then, TEPCO's thermal power plants were not affected by the quake and could continue functioning properly. TEPCO was also able to bring in an additional supply of 4.7GW within a few weeks, but this still left TEPCO hovering dangerously at a low reserve margin averaging 1.7 percent and -5.1 percent immediately following the quake.5 Power supply was boosted by increasing operational capacity at TEPCO's other facilities, shifting periodic inspection schedules to bring plants under inspection back online, purchasing from private power generators and interchanging power supplies from other electricity providers.

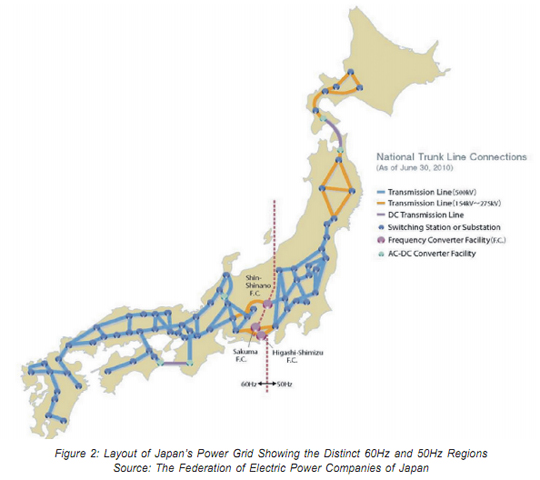

Today, as in 2007, boosting operational capacities at all of TEPCO's undamaged facilities is urgently needed to maintain base load power. Purchasing electricity from private power generators could pose a challenge as electricity generation capacity in all of eastern Japan is now tightly stretched. In the past, TEPCO could tap on the surplus capacity from Tohoku-EPCO, but now the latter is also facing a great supply shortage. Only 0.6GW may be expected to be drawn from the Hokkaido-EPCO further away. As shown in Figure 2, Japan's power grid is divided into a 60Hz section in west Japan and a 50Hz section in east Japan.6 At present, these do not interact and TEPCO can tap into only a maximum of 1GW from the electric utilities in west Japan through existing conversion equipment.

Following the power shortage event in 2007, there were many discussions about the need to expand the interconnection of transmission lines, but little action was taken to put in place higher reserve margins and create effective strategies to ensure stable electricity supplies when large power generation capacities are suddenly lost. What had been left as a future thought has now returned to haunt electricity companies and regulators. Now, even as TEPCO urgently tries to get all possible thermal power plant capacities up and running, it will most likely suffer an 8GW power shortage this summer when the demand for air conditioning is at peak level.7

LNG to fill the gap

To cope with this obvious looming power shortage situation, TEPCO representatives have said they will consider building numerous small 0.3GW LNG-fired power plants which can be completed fairly quickly.8 However, this effort could be rendered ineffective by logistical bottlenecks at the four LNG terminals presently operated by TEPCO, which may not be adequately prepared for a sudden major increase in the number of LNG tanker arrivals.

In the coming months, these logistical issues must be resolved as TEPCO will most likely depend more on natural gas rather than coal or oil to fill its supply gaps in compliance with Japan's Kyoto Protocol commitment to accelerate the shift to natural gas.

The acceleration of LNG usage in the medium to long term will be further pushed by the unfortunate coincidence that many of TEPCO's power plant facilities currently under construction are would-be extensions of stricken facilities, such as the Fukushima Dai-ichi nuclear power plant and the quake-damaged Hitachinaka coal-fired power plant. In the face of these issues, TEPCO can still look forward to the full recovery of the Kashiwazaki nuclear plant and the completion of the Kannagawa hydroelectric power plant, potentially adding 5-6GW of power generation capacity. It may also take some comfort in the fact that the average prices of LNG arrivals in Japan in the three months following the 2007 Chuetsu earthquake showed no remarkable gains compared with the same period in the previous year even as the volume of LNG imports rose 20 percent.

With that said, the current circumstances may have a larger impact on LNG demand and prices than in 2007. The nuclear crisis at Fukushima could force Japan to re-examine its 17 nuclear power facilities around the country and its plans for nuclear power going forward. Already, TEPCO has been asked by local authorities to conduct checks at the Kashiwazaki nuclear plant.9

Many worry that Japan would double back on its plans for nuclear power and push Japanese utilities to collectively increase their reliance on LNG. A large shift from nuclear power to LNG-fired power generation will reverse Japan's energy diversification and may expose the country to new vulnerabilities arising from heavy dependence on foreign LNG imports.

However, a wide-scale reduction of nuclear power generation in Japan, which accounts for 30 percent of electricity power generation, in the next few decades is unlikely as nuclear power development has been a national long-term strategy since the 1970s. Reducing the reliance on nuclear power would also hinder the country in achieving its CO2 emissions reduction commitment in the Kyoto Protocol. It is estimated that the use of nuclear power lowers Japan's CO2 emissions by 14 percent per year.10

Conclusion

Japan's endeavors to lower its CO2 emissions footprint and achieve a high level of energy diversification has meant the country has inadvertently allowed itself to rely heavily on two sources of energy for electricity, both highly risky in their own right--nuclear power for the safety issues and LNG for the logistical chokepoints and foreign import dependence. These risks can be better managed if greater efforts are made to reconcile the 60Hz and 50Hz grids so that more spare capacity may be used to aid sudden and severe power shortage events faced by one or a cluster of utilities.

Japanese electricity utilities and regulators must heed the tough lessons meted out by unplanned natural calamities and work harder in tandem to secure the country's energy future.

==================================

All website references were accessed in March 2011.

1 Japan Electric Power Information Centre Operating and Financial Data 2009

2 "Status of TEPCO's Facilities and its Services after Tohoku-Taiheiyou-Oki Earthquake", 26 Mar 2011

3 TEPCO Corporate Brochure 2011

4 T. Murakami et al., "Impacts on International Energy Market of Unplanned Shutdown of Kashiwazaki-Kariwa Nuclear Power Station", 2008, Institute of Energy Economics, Japan

5 2010 TEPCO Illustrated

6 "Japan's Two Incompatible Power Grids Make Disaster Recovery Harder", Scientific American, 25 Mar 2011, at <http:></http:>

7 "TEPCO Loses One Quarter of Supply Capacity, Urges Restart of Thermal Power Generation", 17 Mar 2011, The Denki Shimbun

8 "TEPCO Considers to Build New Gas-Fired Power Plants", 19 Mar 2011, The Denki Shimbun

10 Japan Country Analysis Brief, Energy Information Administration

By : Valerie Choy, ESI Energy Analyst